IEA warns of severe copper shortage on land by 2035 as deep sea miners propose to retrieve millions of tonnes

The world has a copper supply problem. Can deep sea mining help solve it?

One of the critical minerals that deep sea miners are proposing to extract from the Pacific Ocean will be in extreme shortfall globally by 2035 and the International Energy Agency, IEA, has sounded an alarm.

The IEA was extremely concerned about the supply of copper as it launched its Global Critical Minerals Outlook 2025 report this morning in Paris.

Executive Director, Fatih Birol, said accessing enough copper will be "a headache for the energy sector" in years to come.

"When we look at the energy market, we see that the electricity demand is set to go up at unprecedented levels. In addition to the usual drivers of electricity consumption, we see the demand being driven by AI, electric cars, and in many developing counties, an increasing number of air conditioners. Electricity means copper. When you build a transformer, you need copper. When you build electric grids, transmission lines, you need copper. Electric vehicles, you need copper."

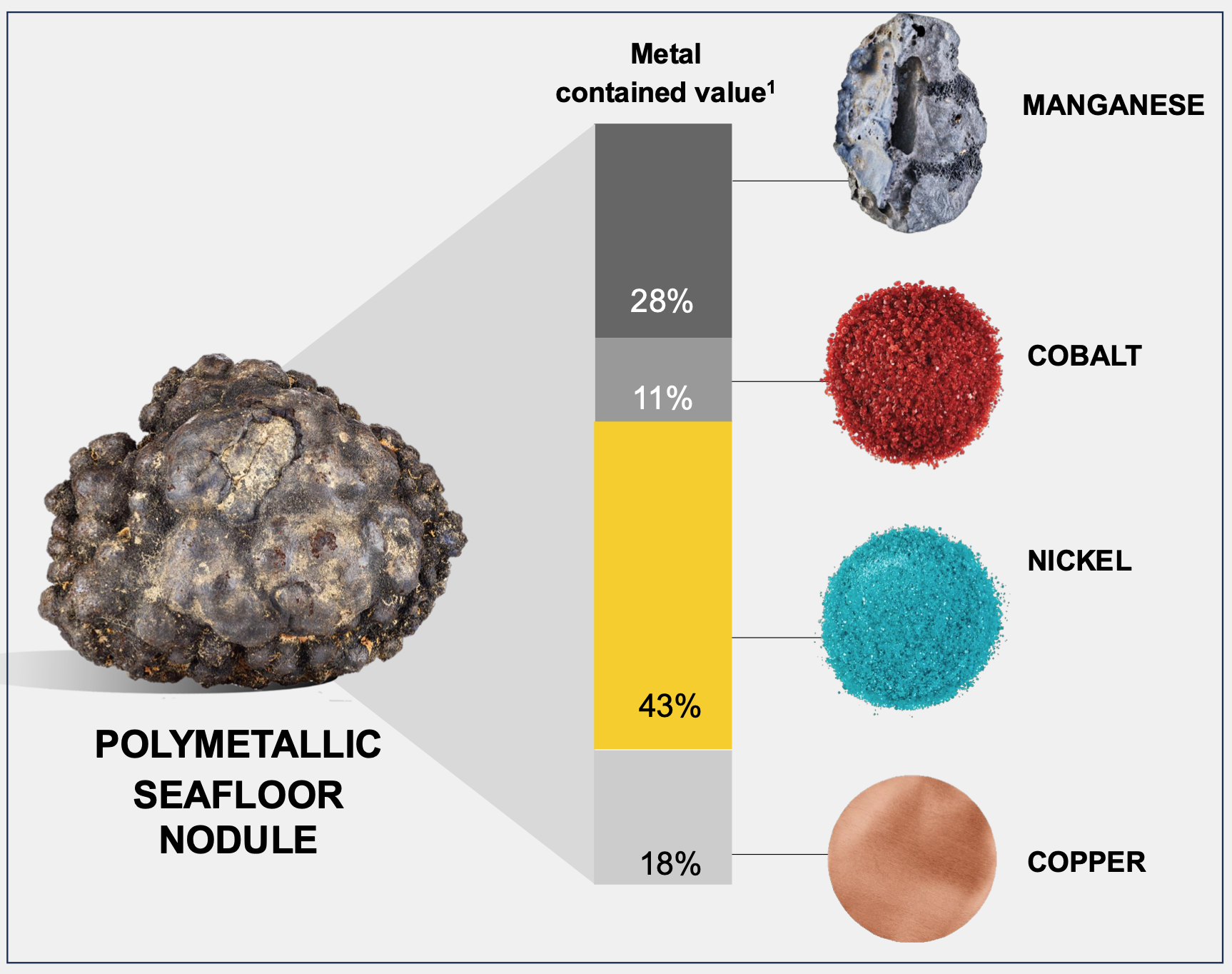

Based on the IEA report, the market for other critical materials contained in polymetallic nodules - nickel, cobalt, lithium - will balance out within the next ten years (based on land supply), but not for copper.

Lithium is also expected to fall short (based on land supply), but the IEA report says prospects for developing new lithium projects (on land) are much more favourable than for copper.

The Copper Conundrum

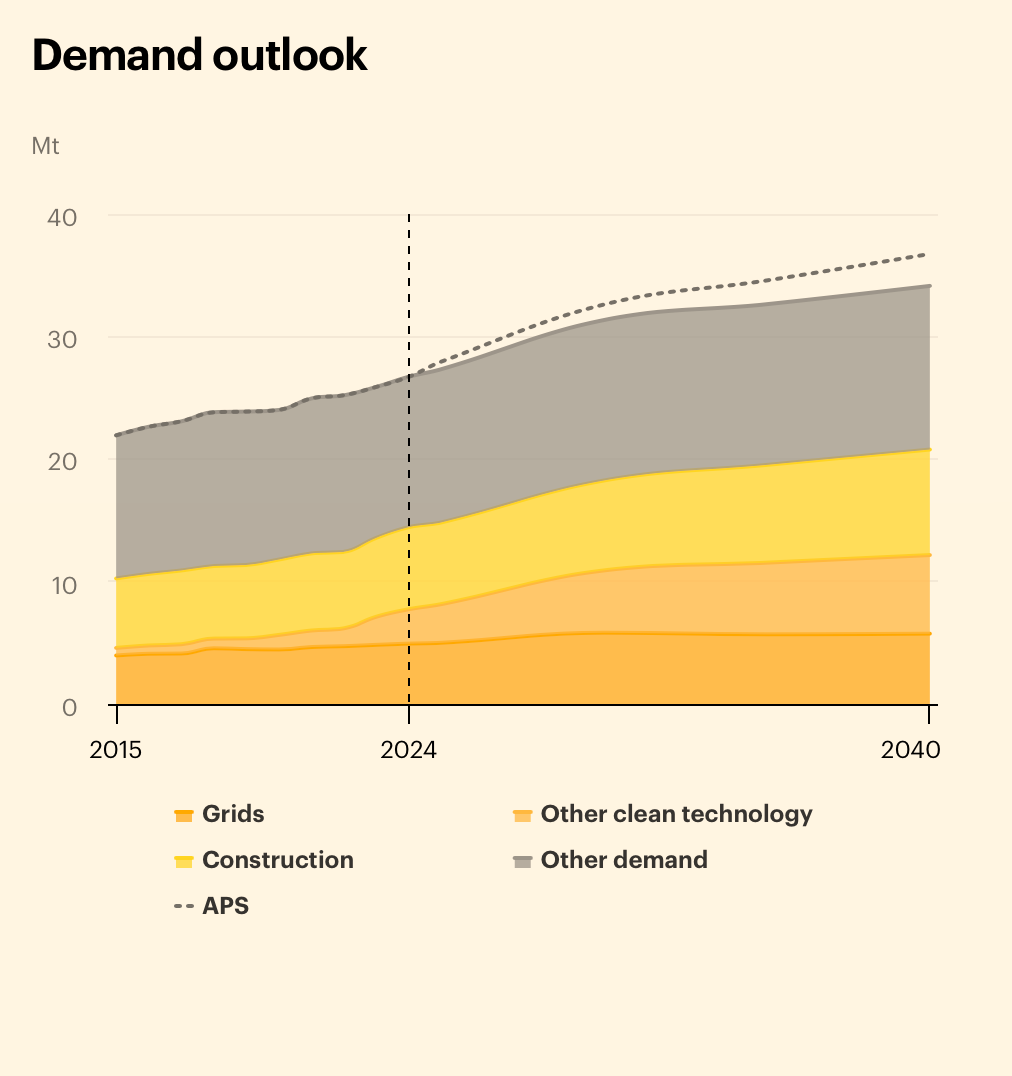

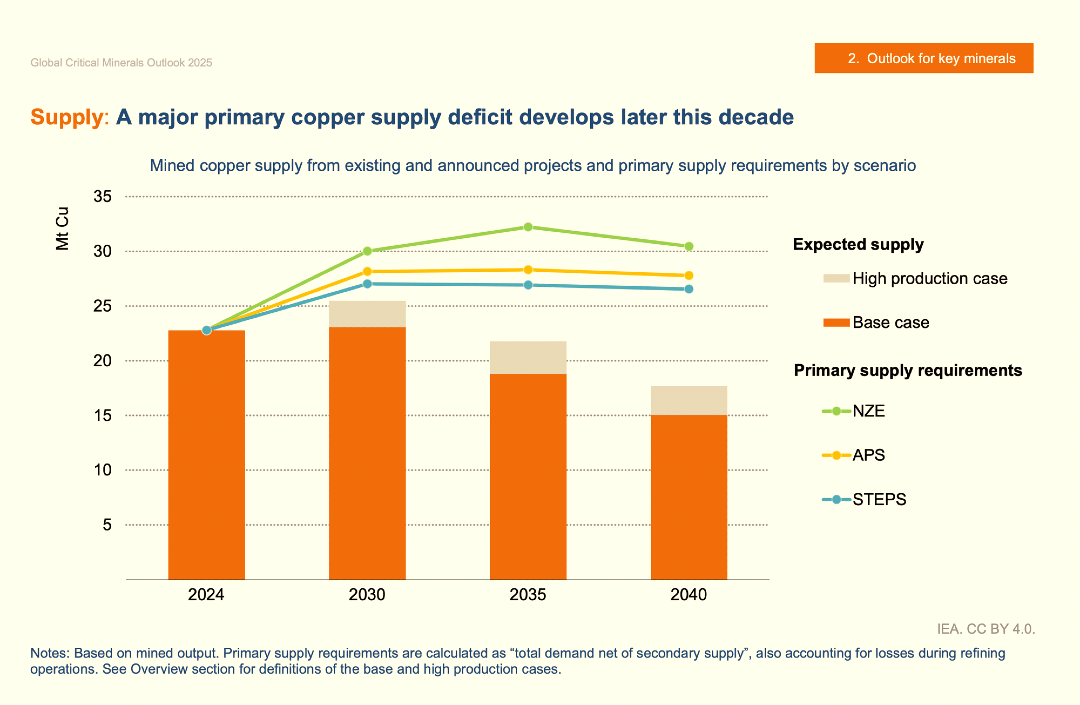

Last year, 24 million tonnes of copper was used globally. Demand for the metal is expected to grow to about 34 million tonnes by 2040, but terrestrial supply will not meet market demand. The shortfall is expected to be approximately 30 percent by 2035, based on existing supply sources and pipeline projects.

At this morning's launch of the report, the IEA head pointed to lack of investment, declining quality of copper in the mines, and infrastructure issues as the key factors underpinning the copper supply problem.

Birol said even if all the mining projects in the current pipeline are executed seamlessly, there will still be a problem:

"Let’s not forget it cannot be solved from one day to another because the team looked at all the projects completed up to now and it takes on average 17 years between you discovering copper in a mine and the first copper production. There’s a long lead time so it can’t come to the market quickly”

Deep Sea Copper

Although it mentions deep sea mining in the report, the IEA does not factor in deep sea minerals into supply figures since there has been no commercial recovery so far.

However, the International Seabed Authority estimates that there are approximately 230 million tonnes of copper in the polymetallic nodules found in the Clarion Clipperton Zone of the Pacific Ocean.

The ISA, which is responsible for regulating deep sea mining and issuing licences, has been developing a mining code to oversee the activity. It hopes to complete it this year amidst controversy and pushback from conservationists and 33 countries requesting a moratorium.

Canadian miner, The Metals Company (TMC), is the front runner among commercial entities hoping to recover the polymetallic nodules through deep sea mining. TMC estimates that it has approximately 12.8 million tonnes of copper within its existing exploration areas.

The company has bypassed the ISA and applied for a commercial recovery permit through the United States to access the nodules. TMC says it hopes to start collecting them by 2027 and has promised a pre-feasibility study showing its plan by end of September.

According to TMC, copper is the third largest abundant metal contained in the seabed nodules:

The Global Critical Minerals Outlook 2025 takes note of the regulatory issues now taking place regarding deep sea mining in a pull out (Box 1.2, pg 39) of the report called Deep-sea mineral resources: what comes next.

In this section, the IEA outlines the state of play at the International Seabed Authority, mentions TMC’s pivot to the US regulatory framework, and notes that the next meeting of the international regulator in July will be pivotal.

The report also mentions deep sea minerals in the context of Japan’s latest energy strategy, noting that it is part of the country’s energy security plan along with stockpiling and diversification (pg. 276).

Processing concerns

One of the supply chain issues to be addressed in TMC's feasibility report and for any miners applying in future for an ISA licence is how the minerals in the polymetallic nodules will be handled after recovery.

China overwhelmingly controls most of the processing of copper and other critical minerals needed for the energy transition and the IEA Executive Director said this is a major concern globally from a security standpoint.:

"Anything can happen. There can be an extreme weather event, technical failure, earthquake, geopolitical event - these can all have a measured impact"

He urged other governments not to rely on market forces, but to employ a series of measures to address the imbalance:

"My suggestion to governments around the world - you cannot solve this problem only by relying on market forces. There’s a need for government policies, strong and urgent - to provide financing for projects for mining and refining, to put mechanisms in place to address the price risk and mechanisms to guarantee demand. In the absence of government policies, this level of concentration will not come to the levels of diversification that the IEA would like to see."

Birol also suggested that resource rich countries should partner with other countries to help build out refining capabilities.

19 out of the 20 critical minerals covered in the IEA report are refined predominantly in China as Deep Blue League discussed in this piece.

The IEA notes the "recent awakening" around the need for critical minerals in the 21st century, considering their importance to decarbonisation, AI data centres, defence weapons, and a host of consumer applications.

However the executive and research team stressed that more attention needs to be paid to the refining issue.

"Diversification is needed as soon as possible in mining but more important, the refining. There is an awakening and a big chunk of this awakening is about the mining, but even more important is the refining".

Despite the abundance of deep sea minerals, environmentalists and some marine scientists are against retrieving them, citing lack of enough robust scientific information about the impact.

Read:

Global Critical Minerals Outlook 2025, International Energy Agency

Watch:

For editorial comments or questions: [email protected]