Korean firm explores building US refinery for deep sea minerals as it takes 5% stake in The Metals Company

The Metals company needs a credible onshore strategy for its future deep sea metals. Is an 85 million dollar partnership with a major Korean refinery the answer?

The Metals Company has announced an 85 million dollar partnership with a major Korean refinery interested in using its future deep sea minerals to make pCAM, an essential component of some electric vehicle (EV) batteries.

TMC and Korea Zinc are exploring the possibility of building out refining capacity for pCAM in the United States using the nickel, cobalt, and manganese contained in the deep sea nodules that TMC hopes to surface once it gets a licence.

Korea Zinc is investing $85M for about five percent of TMC and a non-voting seat on its board.

The firm is also now testing some of the polymetallic nodules that TMC previously surfaced (under its exploration contract with the International Seabed Authority) to 'validate' their processing and refinement at its existing plant in South Korea.

Western strategy

The move, announced today, is part of Korean Zinc's strategy to build out its mid-stream supply chain for western markets which are increasingly desperate to move away from China suppliers.

CEO Yun B. Choi says:

"We are excited to be an investor in TMC, who I believe will be one of the most competitive nickel and copper producers in the world.”

“More than that, I am particularly bullish on the opportunity in critical minerals processing capacity in the United States, and with this new partnership between Korea Zinc and TMC, we now can have a relevant position in this market, having a unique platform upon which a reliable and independent nickel supply chain can be built in the United States, serving U.S. companies and consumers."

China overwhelmingly controls all levels of the market from mining of the component metals to their refinery, to the precursor materials like pCAM, to assembly of the batteries, and finally the production of the vehicles themselves (as well as other end use technologies).

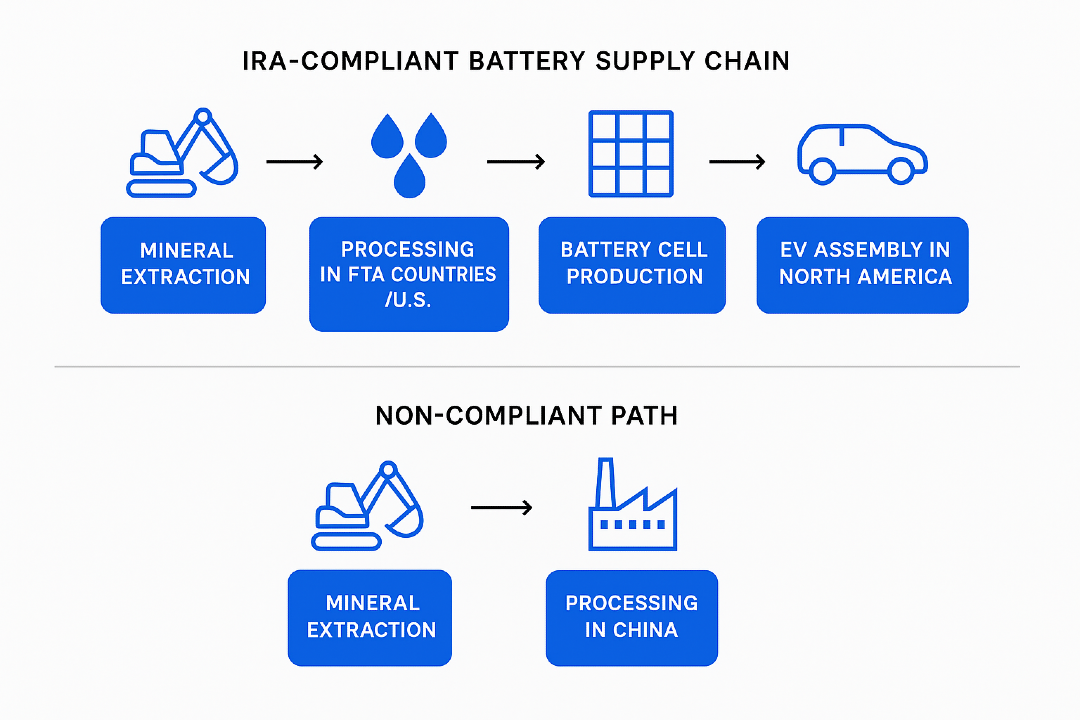

The US, which labelled this dependence on China a national security emergency, is eager to build its own supply chain and has offered generous tax credits to encourage this, through the three year old Inflation Reduction Act.

Components of the US $7,500 EV tax credit requirements

| Portion | Requirement | 2025+ Rule |

|---|---|---|

| $3,750 (critical minerals) | 40%+ of the value of critical minerals (e.g. Ni, Co, Mn, Li) must come from the U.S. or FTA partners | Cannot come from “foreign entities of concern” (FEOC) like China |

| $3,750 (battery components) | Battery components (anodes, cathodes, cells, modules) must be assembled or manufactured in North America | No Chinese battery components allowed from 2024 onward |

Processing deep sea minerals

In keeping with the ongoing strategy, the US wants TMC to process any future deep sea minerals domestically although a short term exemption may be granted, as discussed in a previous Deep Blue League story.

The Canadian mining company has been figuring out its onshore strategy for the nodules as it continues to update its pre-feasibility study, due by end of September.

Today, TMC CEO Gerard Barron heralded the partnership:

"Korea Zinc is probably the only company outside of China that has the capability to take TMC USA’s materials and turn them into metal product formats required in the United States. Together, we have the potential to meet the United States’ demand for refined nickel, cobalt and manganese, and contribute copper while completely by-passing the Chinese supply chain.”

“This is more than capital—it’s alignment on values, on urgency, and on building a resilient supply chain for the United States."

pCAM

Developing pCam, or precursor cathode active material, is an important stage in the lithium-ion battery chain.

It's a powder-like substance made of critical minerals and is a precursor to the cathode used in nickel battery chemistries, which heavily dominate western markets.

China is moving away from them in EVs, focusing on mineral-free alternatives, but the Asian country still dominates the market for all battery chemistries causing US reliance.

Battery manufacturing competition

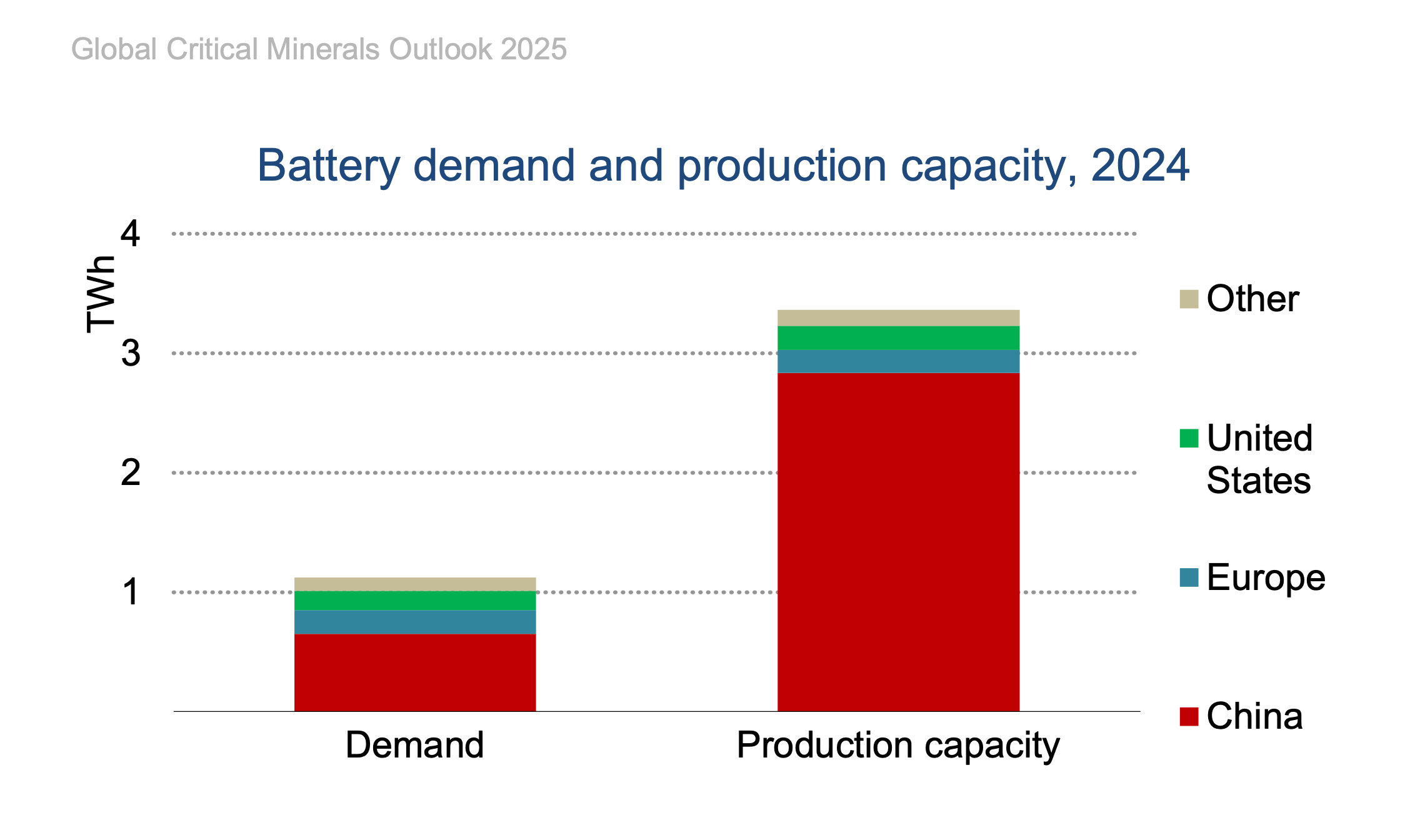

The International Energy Agency says the battery manufacturing market is "maturing and entering a period of consolidation and intense competition" with capacity growing by 30% last year.

Around 85% of that was in China, however battery production capacity grew by almost 50% in the United States last year following the Inflation Reduction Act which rapidly increased investments.

IEA Global Critical Minerals Outlook 2025, page 57

However, pCAM and CAM production which are the midstream part of the supply chain, remains lacking in the US.

Several projects have been announced for development in the last few years, and TMC and Korea Zinc are hoping to be one of the players.

Korean influence

Korean companies already play a big role in western battery production providing a more friendly alternative to China, whose suppliers are dubbed 'foreign entities of concern" by the United States.

In 2024, Korea's LG Energy Solution, Samsung SDI and SK On owned almost 85% of battery production capacity in the European Union and 40% in the United States.

However the IEA notes that China continues to produce two-thirds of nickel-based cathode material, over 90% of anode material and 80% of global battery cells.

Today's deal between TMC and Korean Zinc will be finalised on 26 June and involves a a purchase agreement for over 19.6 million shares and a three year warrant, details of which can be read about in TMC's related SEC filing.

Korea Zinc is testing TMC's nodules under a Letter of Intent.

On the back of the news, TMC’s stock price rose near 30% in trading today which is still ongoing at the time of publication.

Read:

For editorial comments or questions: [email protected]