Why Impossible Metals won't be deep sea mining anytime soon

Impossible Metals is out the starting gates, but it'll be years before it can lower its proprietary robots for commercial activity. Is its US regulator, BOEM, tougher to get past than the International Seabed Authority?

When seabed mining company, Impossible Metals, submitted its first application to start the leasing process for a section of the US seabed in February last year, it was the first time the US Bureau of Energy Management (BOEM) had received such a request.

Under the Outer Continental Shelf Lands Act, BOEM is allowed to review bids from any American seeking to explore the minerals that populate the seabed of US waters.

And the seabed up to 200 nautical miles from any US coast or territory is entirely within its remit.

But so far, BOEM had only been mapping the critical mineral deposits to create a database of where they are and in what quantities.

Its time had been spent managing other non-mineral resources in US waters, like oil and gas, or issuing non-competitive leases for sand to shore up coastlines.

But in February 2024, along came Impossible Metals.

The California based start up submitted a request to have a competitive lease process begin for rich deposits of nickel, cobalt, copper, manganese, and rare earths off the coast of American Samoa.

But it was not to be.

“The BOEM Director opted not to initiate the steps leading to the offer of OCS minerals for lease, determining that further engagement with the government of American Samoa regarding this matter would be appropriate before any further action" BOEM explained of its decision in an email to the US Congressional Research Service a year later.

In the aftermath of BOEM's rejection, the then Governor of American Samoa doubled down with a deep sea mining moratorium last summer.

Second submission

But Impossible Metals CEO, Oliver Gunasekara, was not deterred. And when Donald Trump returned to office in January 2025 with an urgent drive to secure America's domestic minerals supply chain, the serial entrepreneur saw his chance to try again.

The Delaware incorporated company resubmitted its application this April, and in keeping with leasing procedure rules and the shifting political winds, the approval was granted within the prescribed 45 days.

Long leasing process

But this is just the start of a very long road.

For, the journey from the initiation of the leasing process, which happened on 20 May, to actually issuing the lease is laborious.

And the journey to actual deep sea mining, even longer.

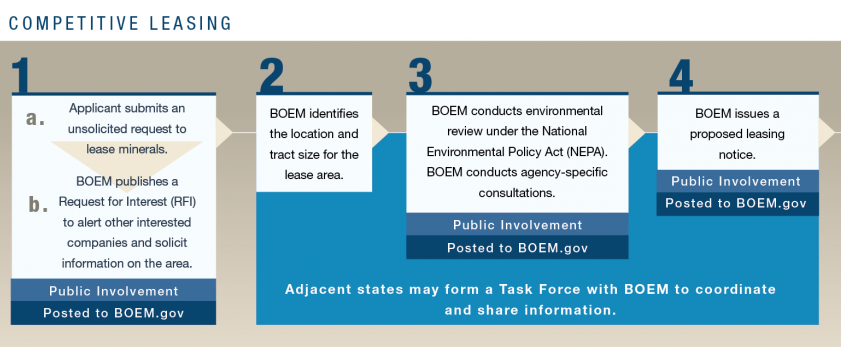

For one, it involves four opportunities for public engagement.

Competitors and other users of the seabed

Having initiated the leasing process, BOEM will now officially alert potential competitors who may also wish to participate in the auction to secure the lease. Since BOEM also manages other offshore activities, it must alert those stakeholders and other users of the area, like fishers, to ensure there are no conflicts. Or to manage them.

Environmental consultations

Once it has identified which area of the seabed is okay to lease, extensive engagement with environmental agencies will then begin.

BOEM has many partnerships it is likely to consult in the process:

The Bureau says it will be guided by the National Environmental Policy Act, the Endangered Species Act, and the National Historic Preservation Act.

Crucially, anyone or any agency can submit information to BOEM once it publishes a request for information, including the public. And the leasing procedure is clear:

All information provided to the Secretary will be considered in the decision whether to proceed with additional steps leading to the offering of OCS minerals for lease.

States and local governments, industry, other Federal Agencies, and all interested parties (including the public) may respond to a request for information and interest."

§ 581.12 Request for OCS mineral information and interest.

Governor's feedback

After the environmental checks have been satisfied to ensure safeguards and mitigation of ecological damage, governors of the nearest states (in this case American Samoa) will get the opportunity to weigh in after their own consultations.

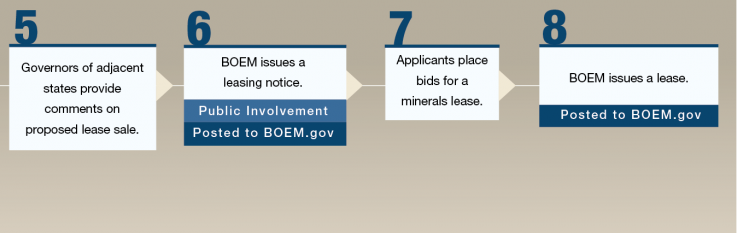

Only having satisfied all of the above to a high standard, can BOEM proceed to run a competitive auction to the highest bidder.

Impossible Metals will then have to compete, along with any other interested parties vying to pay annual rent and royalties to the US treasury for the minimum 20-year-lease.

'Burdensome" post-lease plans

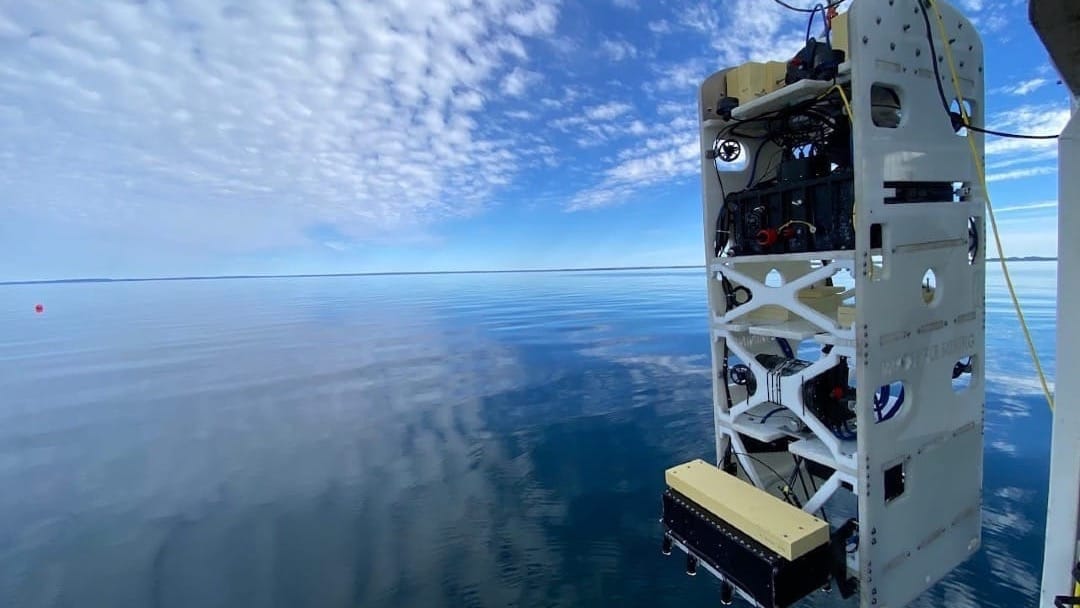

But even if it wins the lease auction, Impossible Metals would still be nowhere near putting its robot technology in the water to recover the polymetallic nodules.

Beyond the lease, BOEM will still need to approve a plan from the lessee to test mine and another separate plan to commercially mine the minerals. The actual deep sea mining plan must include how the minerals will be developed and processed, as well as a programme to address environmental impacts.

Each round of plans, from test mining to actual commercial mining, will be subject to public comment by the American Samoan governor of the day and relevant federal agencies.

The GOP Congressional Committee on Natural Resources, which has held two hearings on deep sea mining this year with Gunasekara in attendance, calls the above steps 'burdensome'.

The Republican controlled committee wants a more streamlined, expedited process that would make it easier to extract the minerals, and by extension, for the United States to achieve its goal of minerals independence.

BOEM reform guidance

For guidance, the bi-partisan Congressional Research Service of the US House of Representatives has provided a paper listing the parts of BOEM that Congress could consider reforming.

Last updated a week ago, it flagged the following:

The Jones Act or Dredge Act

Both the Jones Act and Dredge Act are old laws requiring US vessels operating between two US points to be made in the United States and staffed by US citizens. The Jones Act doesn't apply to US territories in the Pacific Ocean like American Samoa but it's possible the Dredge Act might, and researchers have flagged it for congress to consider whether it might be an additional burden for would-be deep sea mining companies.

Preferential rights to leases

Potential seabed miners with BOEM permits to explore the US OCS do not have any advantage in gaining future commercial leases for the same areas in which they might have done prospecting. Congressional researchers point out that, in this respect, BOEM’s regulatory framework is actually tougher than the International Seabed Authority's. The ISA, which governs deep sea mining in international waters, will give priority to its exploration contractors when issuing exploitation licences.

Upating BOEM regulations

Joe Biden's administration amended the definition of 'OCS' and 'states' in BOEM's parent law to include US territories like American Samoa. However, congressional researchers point out that BOEM regulations have not been officially adjusted to account for this:

"Congress may consider making this clarification in light of areas off U.S. territories that have been identified as having potential for critical mineral resources and Impossible Metals’ April 2025 request to BOEM to commence a leasing process for exploration and potential development of critical minerals offshore of American Samoa.

Congress could choose to restrict critical mineral leasing in these areas (e.g., for environmental protection and conservation purposes) or could direct BOEM to offer leases"

Given the moratorium implemented by American Samoa's previous governor, and contentious public sentiment, clarity may prove useful.

Funding

The Congressional researchers also pointed out that Congress could increase funding for BOEM as it undertakes these new extensive activities.

Critical Minerals Environmental Assessment Framework

BOEM had only just sought budget approval for the development of a Critical Minerals Environmental Assessment Framework to help improve its analyses in light of deep sea mining applications.

In a 2023 case document, the energy agency sounded ill-prepared and said the information needed to protect the area was 'sparse'.

BOEM said it was lagging in what's required to provide "effective stewardship of the Outer Continental Shelf" in relation to critical minerals (CM).

"In light of potential impending requests to develop OCS critical mineral resources, BOEM needs this CMEAF project to inform environmental assessment guidance related to prospecting, leasing, and developing offshore CM, culminating in a comprehensive document that addresses the CM affected environment, the impact of CM recovery, transport, and refining processes, baseline data needed to assess these systems, and the environmental impacts associated with various prospecting and operational methods"

The framework is ongoing, having been scheduled for development between 2024 and 2026.

"Now is the time"

For its part, Impossible Metals would like to see clear timelines for each stage of the leasing process. The CEO urged congress to set them at the hearing in April:

" Most steps that involve BOEM’s decisionmaking and analysis do not have a defined timeline. Setting such timelines, even generous ones, would provide greater predictability."

Still, the company is preparing for the long haul ahead and is no doubt pleased the journey has started:

"Now is the time"

Read:

For editorial comments or questions: [email protected]